FAQs

1. Filing a PERSONAL Income Tax Return (T1)

Any individual who has earned income in Canada and/or who is considered resident for tax purposes in Canada must file an annual tax return according to the following dates:

-

April 30 for an employee

-

June 15 for an entrepreneur, consultant or freelancer

-

June 15, if an employee is filing married or common law with a husband who is entrepreneur.

Note that in any of the cases above, Taxes due are to be paid by April 30 regardless of the filing deadline.

2. Filing an GST/HST OR Other SALES Tax Return

In addition to Filing the Income Tax Return, any entrepreneur, consultant or freelancer with sales over $30,000 in the year or who has registered for HST must collect and file an HST return no later than 3 months after year-end by March 31.

3. FILING A CORPORATE TAX RETURN (T2)

All companies must file an annual income tax return (T2) 6 months after their year-end. Note that although the filing is due 6 months after year-end, any amount of taxes is due 3 months after year-end.

4. PAYROLL FILING (PD7A, T4, T4A)

All companies must make payroll remittances on a monthly basis, no later than the 15th of the month for the previous month-end. An annual payroll summary (T4) is filed at year-end by Feb 28. This date is also the deadline for filing the contractors ‘payment summary (T4A) and the dividend summary (T5).

5. NON-RESIDENT REMITTANCE RETURN (NR4)

A Canadian non-resident return must be filed at year-end no later than Mar 31 for all income received by a non-resident from Canadian source.

6. Interest and penalties on late taxes

You will be charged interest on any taxes that you owe if you pay late. You will also be charged a late-filing penalty if you have a balance owing and file your tax return late.

-

The interest rate charged on overdue taxes, Canada Pension Plan contributions, and employment insurance premiums will be 8%.

-

The interest rate to be paid on corporate taxpayer overpayments will be 4%.

-

The interest rate to be paid on non-corporate taxpayer overpayments will be 6%.

-

The interest rate used to calculate taxable benefits for employees and shareholders from interest‑free and low-interest loans will be 4%.

If you file your tax return after the due date and have a balance owing, you will be charged a late-filing penalty. Filing late may also cause delays to your benefit and credit payments. If you cannot pay your balance owing, you should still file on time to avoid being charged the late-filing penalty.

-

The late-filing penalty is 5% of your 2022 balance owing, plus an additional 1% for each full month that you file after the due date, to a maximum of 12 months.

- If the CRA charged a late-filing penalty for 2019, 2020 or 2021 and requested a formal demand for a return, your late-filing penalty for 2022 will be 10% of your balance owing. You will be charged an additional 2% for each full month that you file after the due date, to a maximum of 20 months.

7. PAYROLL penalties and InterestS

Payroll penalties are assessed for errors in calculation, deductions, paying (remitting) or filling. If you do not pay an amount that is due, the CRA may apply interest from the day your payment was due

-

Penalty for failure to deduct – CRA will assess a penalty of 10% of the amount of Canada Pension Plan (CPP), employment insurance (EI), and income tax you did not deduct. If you are assessed this penalty more than once in a calendar year, CRA will apply a 20% penalty to the second or later failures if they were made knowingly or under circumstances of gross negligence.

- Late or non-payment (remittance) – CRA will assess a penalty when you deduct amounts over $500, but do not send them to CRA or send them late.

The penalty is:

o 3% if the amount is one to three days late

o 5% if it is four or five days late

o 7% if it is six or seven days late

o 10% if it is more than seven days late, or if no amount is remitted

o

20% if this is

the second or subsequent time you are assessed this penalty in a calendar year,

if the failures were made knowingly or under circumstances of gross negligence

-

Individuals must file personal income tax returns by April 30 if they are employees or by June 15 if they are sole proprietors, entrepreneurs or free lancers.

-

- All sole proprietors, entrepreneurs or free lancers who registered for GST/HST or who has a total income over $30,000 must file an annual GST HST return.

-

- Business must file either one or all of the following returns:

o Corporate income tax return

o GST/HST return

o Payroll and other remittance return

o

circumstances of gross negligence.

You

must be very careful with people who based their fees on how much refund they

can get you. A tax refund or payment is the result of a carefully prepared

return based on each individual situation. A good

accountant

will take the time to fully understand his client’s tax situation and apply all

tax credits and deductions applicable based on the client’s specifics. Occasionally,

a tax strategy may be implied.

Following our tax return preparation, we will provide you a copy of the return which contains in its first page, instructions. If there is an amount due, you need to make payments to CRA. You must not wait for the CRA formal Notice of Assessment prior to making this payment or you will incur penalties for late payment.

The most common way to make payment to CRA is through the “Pay my bill” option of your online banking. Follow the steps below on your online bank account:

- Pay my bill or make a payment

- Select CRA Annual Income Tax for the Year

- Enter your Social Insurance Number as Account ID

- Make the payment

You must allow at least one business day for CRA to process the payment.

Income from all sources for the year must be reported. This includes income earned during the year prior to migrating in Canada, while in Canada and obtained from a foreign country or after leaving Canada.

Income sources are as follows:

- Employee Income (usually T4 slips)

- Consultant or subcontractor income (usually T4A, T5018 or other summaries)

- Entrepreneur or Freelancer income (usually summary of invoices)

- Rental income (summary of rents)

- Capital gains, dividends and interests from Financial Institutions (T3s and T5s)

Not all are taxable but must be reported. Discuss them with your accountant.

In addition to the reportable income, all foreign assets with cumulative value above $100,000 must be reported along with the tax return on the form T1135.

Once the first tax return has been filed with CRA, we advise our client to register for an online CRA account. The process takes a couple weeks but allows later one the access to all information including correspondences directly from the client account on the CRA website. Refer to link below:

We are a professional Accounting, Tax, Advisory and Audit firm. Although we work on a first come first serve basis, we also tend to organize our work to meet CRA deadlines and to minimize costs to our tax clients. Please let us know in advance if you need special accommodation such as expediting a tax return, an advisory notice or any other such services that may come with an extra cost.

SCG or ESCPA shall bill the Client on a regular basis for services rendered which bills will be due and payable upon receipt of the client copy of the return.

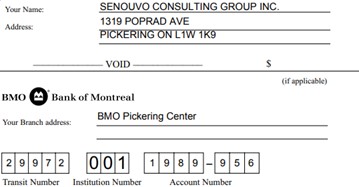

Payment can be made by

- cheque,

- virement Interac à l'adresse yonin@senouvoconsulting.ca

There are 3 tax investment vehicles in Canada. Each of which has advantages and drawbacks:

- The Registered Retirement Savings Plan (RRSP)

The RRSP is by far the most known and preferred tax investment vehicle in Canada. Once a RRSP account is established at any major financial institution, it is registered by Revenue Canada.

It has 3 benefits:

- Any income earned in the RRSP is usually exempt from tax as long as the funds remain in theplan.

- Deductible RRSP contributions can be used to reduce your tax.

- Up to $35,000 can be borrowed towards the purchase of the first principal residence and repaid within 15 years.

Its main drawbacks are:

- Investments made into an RRSP can only be drawn at retirement and are subject to income tax.

- Administrative or other fees in relation to RRSP and any interest or money borrowed to contribute to an RRSP are not tax deductible.

- RRSP contributions room is computed on the basis of the previous year taxable salaried income and any accumulated room which means that first time Canadian workers cannot contribute to an RRSP account in their first year of employment.

Contributions to RRSP must be made before March 1st to be considered for the previous fiscal year.

- The Tax-Free Savings Account (TFSA)

The Tax-Free Savings Account (TFSA) program began in 2009. It is a way for individuals who are 18 and older and who have a valid social insurance number (SIN) to set money aside tax-free throughout their lifetime.

It has 2 benefits:

- Any investment into an TFSA account and additional income earned by this investment is tax free.

- Contrary to RRSP, income from a TFSA account can be drawn at any time tax free.

Its main drawbacks are:

- The contribution room for a TFSA is limited every year to the amount established by thgovernment plus any accumulated room.

- Administrative or other fees in relation to TFSA and any interest or money borrowed to contribute to an TFSA are not tax deductible.

Contributions to the TFSA must be made before Dec 31 for the fiscal year

- The First Home Savings Account (FHSA)

A first home savings account (FHSA) is a registered plan which allows you, if you are a first-time home buyer, to save to buy or build a qualifying first home tax-free (up to certain limits).

It has 2 benefits:

- Any investment up to $8,000/year into an FHSA account and additional income earned by this investment is tax free.

- Contrary to RRSP, income from an FHSA account can be drawn at any time to purchase a first home.

Its main drawbacks are:

- The contribution room for an FHSA is limited every year to $8,000 and only for 5 years

- Administrative or other fees in relation to FHSA and any interest or money borrowed to contribute to an FHSA are not tax deductible.

Contributions to the FHSA must be made before Dec 31 for the fiscal year